The standout quote from day one of CERAWeek in Houston came from Amin Nasser, president and CEO of Saudi Aramco.

“There is more chance of Elvis speaking next than the current plan working,” he told delegates at a packed plenary session, to general amusement all round.

“The current plan” was a reference to the trillions of dollars that have already been spent on the transition away from hydrocarbons, and the many more trillions that environmentalists say have to be spent to save us from man-made global warming.

Given that the King of Rock and Roll has been dead since 1977, and the programme told us that next up on the plenary podium was Mike Wirth, chairman and chief executive of the oil giant Chevron, Nasser must have known he was on pretty solid ground.

But the crack went down well at the annual “oil man’s Davos”, and caught the air of triumphalism that is running through CERAWeek 2025: the fossil fuel men, bolstered by a climate change-denying president and seeing the road to energy transition hitting innumerable bumps, think they have conclusively won the climate change argument.

“With the winds of history in our sails again, let’s use our industry’s vast experience and practical expertise to usher in a truly golden new era of abundant, affordable and sustainable energy for all,” Nasser concluded.

That rhetorical flourish masks a more subtle message from the oil industry: while global warming is a real and urgent threat, banning hydrocarbons – as the smattering of protesters outside the Hilton Americas hotel demanded – is not the way to tackle it.

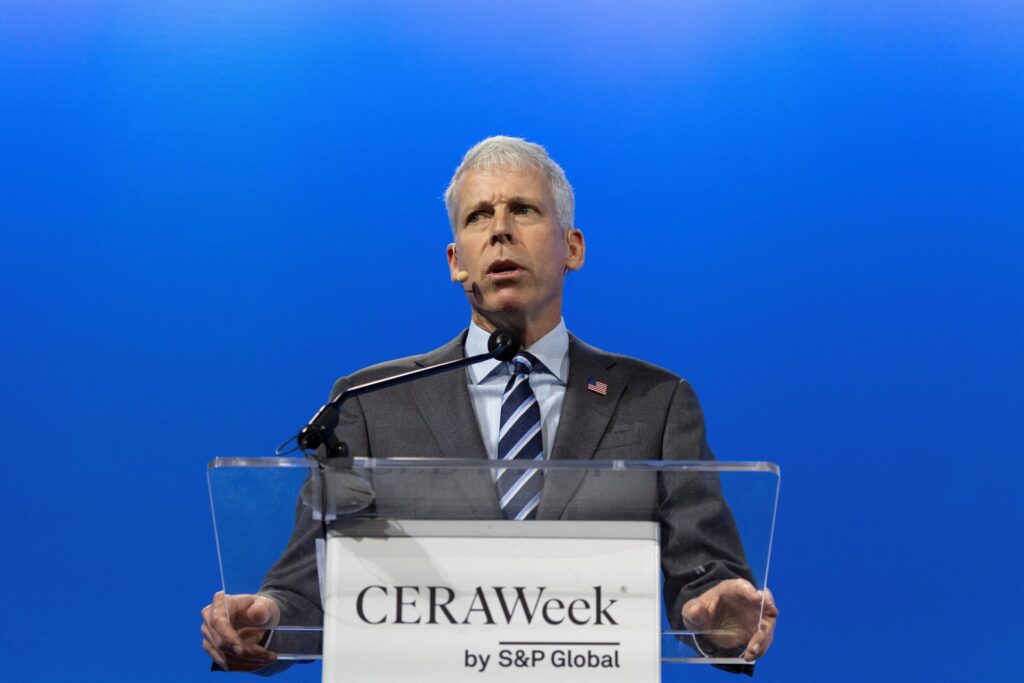

Nasser was on stage after a keynote speech by Chris Wright, the newly appointed energy secretary, who also blew a triumphalist trumpet, but in a much more distinctly American context.

Wright said he was proud to be rolling back the former president Joe Biden’s “myopic focus on climate change” and ending the “quasi-religious” policies of the previous administration in favour of the “scientific and pragmatic” approach of President Trump.

“When it comes to energy policy the only interest groups we’re concerned with is the American people,” he proclaimed to a round of applause.

He said his strategy stood in contrast to that of the “European allies” in the audience, who had sold their “once mighty” steel and petrochemicals industries to Asia and were now importing those products back at great environmental cost.

Wright was full of Trumpian energy and enthusiasm, especially when showing off an agreement to restart US exports of liquefied natural gas.

But at a subsequent press conference, he was less certain when quizzed on specifics of the new US energy policy.

How could he square the circle at the heart of the new administration’s policy – the president’s desire to see gasoline prices as low as possible, with the oil industry’s need for higher prices to make a buck or two?

Prices were not really his concern, he said unconvincingly, but a function of supply and demand. He wanted to “Build, baby, build” rather than “Drill, baby, drill”.

Perhaps with one eye on how Elon Musk would react, he declared he was not against electric vehicles as such, but merely opposed to the idea that they should be subsidised by American citizens, and that they would dramatically reduce greenhouse gas emissions.

Asked by AGBI whether he had a message for his friends in Opec+ who had just begun to put extra barrels back on the market, he fudged: “I’m pleased to see them returning. We’ve only been in office 50 days and already oil prices are coming down.”

That was obviously regarded as good news for him and his boss, but will not be seen as such by most of the oil executives at CERAWeek, nor by the oil producing countries of the Arabian Gulf.

If Wright accompanies President Trump on his mooted visit to Saudi Arabia in the near future, presumably with much of the Houston oil industry in attendance too, he would be well advised to decide which is the new administration’s top priority: happy consumer and voters, or a profitable and grateful oil industry.

Frank Kane is Editor-at-Large of AGBI and an award-winning business journalist. He acts as a consultant to the Ministry of Energy of Saudi Arabia and is a media adviser to First Abu Dhabi Bank of the UAE