Quick recovery for Gulf predicted

Energy products exempt from tariffs

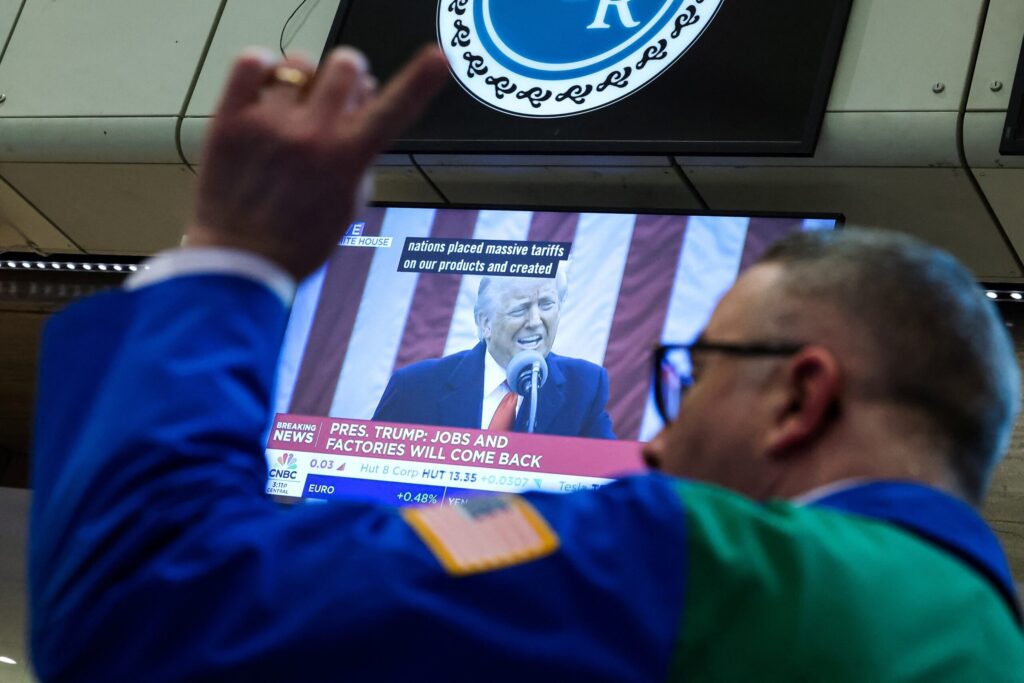

Dubai’s stock index tumbled on Thursday, poised for its biggest daily decline this year, and other Gulf bourses slid after US president Donald Trump announced wide-ranging tariffs on importers.

Losers outnumbered gainers 34 to 10 on Dubai’s benchmark, which was down as much as 2 percent in early trade, mirroring declines on Asian bourses as investors fretted over the probable impact of the tariffs on global trade and economic growth.

“This is a global equity sell-off, nothing specific to Gulf markets,” said Sanat Sachar, a portfolio manager at Azimut Middle East in Dubai.

“Investors are risk-off, selling equities to hold cash while they wait to see how things play out. The Trump tariffs will have little-to-no impact on Gulf exports to the US, which are only a small portion of regional exports anyway, and I expect Gulf stock markets will be the first to recover,” Sachar said.

Dubai bellwether Emaar Properties headed the losers, dropping 8.6 percent to AED12.30 ($3.35).

Tuesday was the cut-off date to qualify for the company’s AED1 per share 2024 dividend, so many investors sold on Wednesday. The stock hit a 17-year high in February but is now down 4.3 percent this year.

Brent crude fell 3.5 percent to $72.35. Gold, normally viewed as a safe-haven asset, slipped 0.4 percent to $3,128 per ounce although within $20 of Tuesday’s all-time peak.

Abu Dhabi’s benchmark fell 0.6 percent and Saudi Arabia’s measure slipped 0.3 percent.

The sell-off comes after Trump unveiled a minimum 10 percent universal tariff on all imports into the US, regardless of origin. This will be effective from April 5.

Further “reciprocal” tariffs will be introduced on April 9 and range from 10 percent on goods from the UAE, Saudi Arabia, Qatar, Egypt and Morocco to 28 percent on Tunisian imports and 20 percent on those from Jordan.

Crucially for Gulf energy exporters, oil, gas and refined products are exempt. In 2023, Saudi Arabia exported $16.5 billion of goods to the US, of which crude and refined petroleum accounted for $14.1 billion and fertilisers $620 million according to The Observatory of Economic Complexity.

Similarly, oil-based products constitute a large proportion of UAE and Qatari exports to the US.

Copper and aluminium prices also fell in Wednesday trade. The MSCI emerging markets index, which includes several Gulf blue-chip stocks, dropped 0.8 percent.

Brent crude’s renewed price slump takes its losses to 12 percent since hitting a five-month high in mid-January.

Historically, Gulf stock markets have been correlated closely to oil prices. This has weakened considerably over the past few years as regional economies diversify from hydrocarbons and domestic growth drivers come to the fore, Sachar said.

“Despite these broad measures GCC countries are less likely to be significantly impacted,” Thomas Vanhee, a partner at Aurifer tax consultancy in Dubai, wrote in a note.

“While direct effects may be limited, there could be indirect impacts. The global trade environment’s volatility, stemming from these tariffs, might influence demand and supply chains, potentially affecting the economies of the UAE and Saudi Arabia.”

Register now: It’s easy and free

AGBI registered members can access even more of our unique analysis and perspective on business and economics in the Middle East.

Why sign uP

Exclusive weekly email from our editor-in-chief

Personalised weekly emails for your preferred industry sectors

Read and download our insight packed white papers

Access to our mobile app

Prioritised access to live events

Already registered? Sign in

I’ll register later