Gulf benefits from low energy costs

UAE exports 350,000 tonnes aluminium

A sharp increase in US tariffs on aluminium and steel imports may inadvertently benefit Gulf producers, thanks to their competitive energy advantage and expanding export footprint.

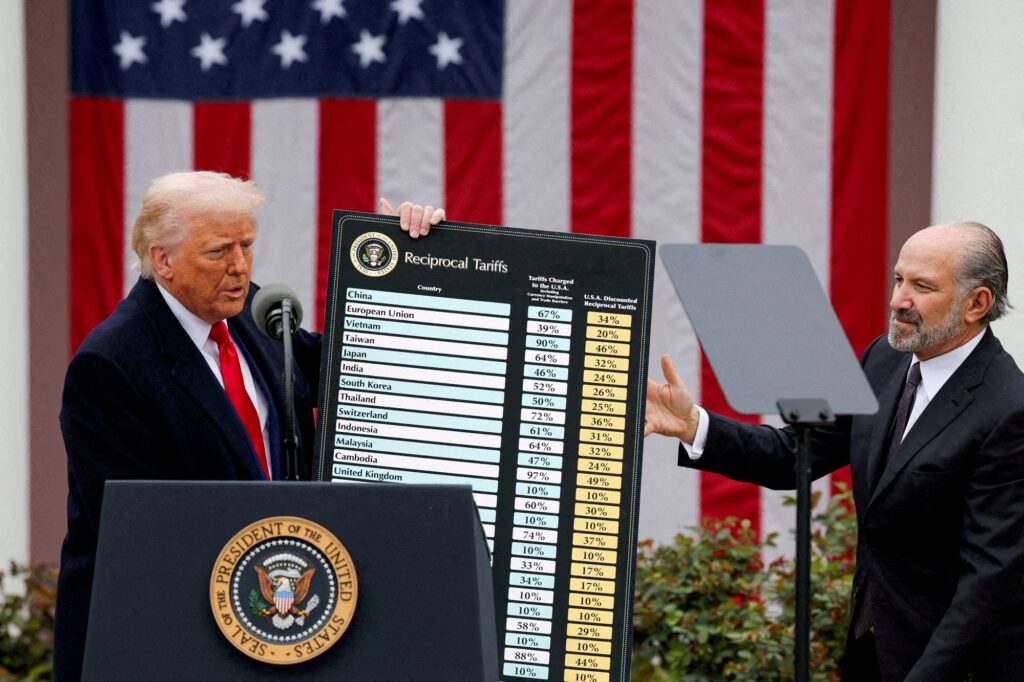

President Donald Trump has announced plans to double tariffs on aluminium and steel imports to 50 percent starting on Wednesday, escalating his administration’s protectionist stance amid ongoing global trade tensions.

“The biggest advantage that GCC producers of steel and aluminium have is that they pay very low energy costs,” said Vijay Valecha, chief investment officer at Dubai-based Century Financial.

“Production of these metals is energy-intensive, so having access to cheap energy helps them stay competitive, even with added tariffs.”

The UAE exported nearly 350,000 metric tonnes of aluminium to the US in 2024, making it the country’s second-biggest supplier behind Canada, which accounted for more than 3.15 million tonnes, according to data from the US International Trade Administration.

Bahrain was also among the top five exporters, with additional shipments coming from Saudi Arabia, Qatar and Oman.

In total, aluminium imports from the GCC accounted for about 16 percent of total US aluminium intake from June 2024 to May 2025.

Bahrain could be the most vulnerable to any tariff hikes, according to James Swanston, senior Middle East and North Africa economist with Capital Economics.

Aluminium and steel exports to the US were equal to 1.6 percent of the kingdom’s GDP product in 2024 “though only 15 percent of its aluminium exports go to the US as opposed to other larger destinations like Saudi Arabia, Turkey and the Netherlands”, he said.

The UAE may stand to benefit particularly from Emirates Global Aluminium’s multibillion-dollar plan to develop a new smelter in Oklahoma.

The project, announced during Trump’s visit to the Gulf in May, is expected to add 600,000 tonnes of annual capacity, nearly doubling US domestic output, and create up to 4,000 construction jobs and 1,000 permanent positions.

“That output would not be subject to the tariff and may be a way to circumvent the tariff by substituting its previous exports from the UAE to the US and instead EGA producing aluminium in US-based factories,” said Swanston.

Gulf states contribute just 1 percent of total US steel imports, mainly from the UAE and Saudi Arabia. The US remains the third-largest export market for Gulf steel, accounting for around 6 percent of outbound shipments.

“Tariffs on steel producers in the region will have some impact,” Valecha said. “However, this impact can be reduced by finding alternative markets.”