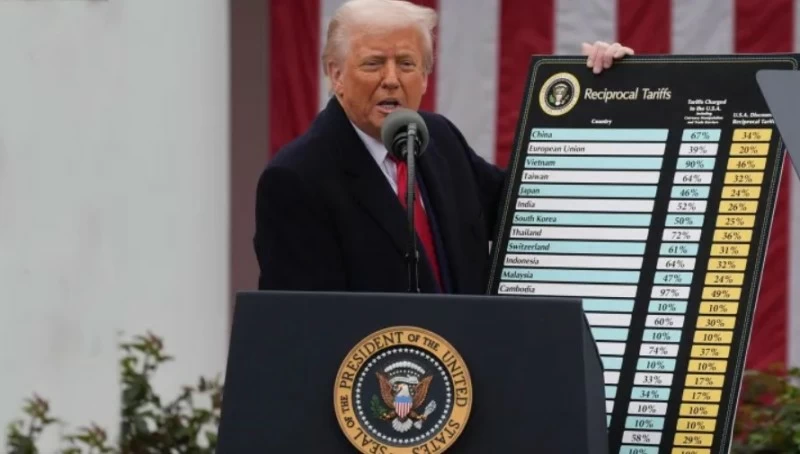

US President Donald Trump said the Supreme Court’s decision to cancel the tariffs was “very disappointing” and expressed his dissatisfaction with some of the judges.

In a press conference hours after the ruling was issued today (Friday), President Trump said he believed the ruling was “against what makes America strong and healthy and great again” and was ashamed that some judges didn’t have the courage to do what they thought was right for America’s interests.

But he praised the three justices who dissented from the ruling, adding that the justices who voted to invalidate the fee were what he called a national disgrace, and said their position automatically vetoes any measure that would strengthen the power of the United States.

President Trump suggested that other countries were celebrating the court’s decision, given that they have benefited from previous trade policies at the expense of the United States, but stressed that the celebration “will not last for long.”

He argued, without providing evidence, that the court was influenced by foreign interests and a political movement that he said was much smaller than some believed, and stressed that the administration would resort to other means to make up for the voided fees.

US President Donald Trump called the Supreme Court’s decision overturning the tariffs “extremely disappointing” and expressed his dissatisfaction with some of the justices.

President Trump said at a press conference today (Friday) hours after the ruling was handed down that he believed the ruling was “contrary to what makes America strong and healthy and great again” and that he was ashamed that some justices did not have the courage to do what they thought was right for America’s interests.

By contrast, he praised the three justices who dissented, adding that the justices who voted to repeal the tariffs were, in his words, a stain on the nation, and said their position was a knee-jerk rejection of any steps that would strengthen the United States.

President Trump noted that other countries are celebrating the court’s ruling, given that they have benefited from previous trade policies at the expense of the United States, but stressed that this celebration “will not last long.”

He argued, without providing evidence, that the court was influenced by foreign interests and political movements that he said were much smaller than some believed, and that the administration would seek other alternatives to make up for the overturned tariffs.