Cerebras

UAE holding in chipmaker is sticking point

US fears over G42’s links to China

Delays continue in official review

Worries in the United States over a stake by an Abu Dhabi company in Cerebras Systems, the US chipmaker, are continuing to leave its IPO in limbo, five sources familiar with the matter said.

The sticking point for California-based Cerebras is the review by the Committee on Foreign Investment in the United States (CFIUS) of a $335 million investment by the Abu Dhabi-based cloud computing and AI company G42.

CFIUS, which is led by the Treasury Department, reviews foreign investment in American companies for national security risks.

G42’s past ties to China have drawn scrutiny in Washington before, but its stake in Cerebras appeared poised for approval late last year.

Cerebras, a smaller competitor to the industry leader Nvidia in the booming AI chip market, faces risks in going public without clarity on G42’s investment, two of the sources said. Investors like certainty, and without it, raising money on the open markets becomes more complicated.

Instead, the company’s listing has been delayed further as executives wait for the White House to fill key appointments and to wrap up the review by CFIUS, said the people, who asked not to be identified because the process is confidential.

The company was hoping the Trump administration would wave through the CFIUS review. The most recent delay, which has not been previously reported, is the latest example of how bets that US President Donald Trump would be a boon for dealmaking have not panned out for Wall Street so far.

With the change at the White House just two months ago, key political positions remain unfilled, including the assistant Treasury secretary for investment security, who oversees CFIUS. While career and political staff currently in place have the authority to approve the deal, the inclusion of G42 made it politically risky over its past ties to China’s Huawei, several CFIUS attorneys said.

CFIUS staffers might be even less inclined to risk a controversial approval on big, politically sensitive deals after seeing billionaire Trump adviser Elon Musk‘s team at the Department of Government Efficiency cut thousands of workers in a bid to slash federal payrolls and root out disloyalty, national security lawyers said.

Cerebras and the Treasury Department declined to comment. The White House did not respond to a request for comment. It is not unusual for presidents to take months to fill non-cabinet-level positions at key agencies.

G42 declined to comment on the CFIUS process.

“G42’s progress in the US and in key European markets reflects the growing confidence in our role collectively building the Intelligence Grid for responsible AI,” it said in a statement to Reuters.

While Trump laid out new parameters last month that “fast-track” foreign investments in US companies, they further restrict those coming from China, particularly in strategic sectors such as technology.

That is bad news for companies such as G42, which is a major investor in and the largest customer of Cerebras. It had close ties with China’s Huawei before Microsoft gave it $1.5 billion. To get the investment cleared, it had to cut Huawei off and sign a national security agreement with the US last year.

Despite the holdup, Cerebras executives remain confident that the deal will eventually go through and intend to proceed with the IPO once it receives approval, according to three people familiar with their thinking.

Cerebras and G42 jointly filed to notify CFIUS of the investment. They later amended the filing, stating that the shares G42 would acquire are non-voting securities, which they argued should not be subject to CFIUS review.

Last September, the companies requested to withdraw the filing altogether, and CFIUS is now considering that request, according to Cerebras’s IPO filing.

Cerebras, valued at about $8 billion after G42’s investment commitment in May last year, has since nearly doubled its valuation, one of the people said. If the investment wins approval, G42 would end up with a stake of more than 5 percent in the company.

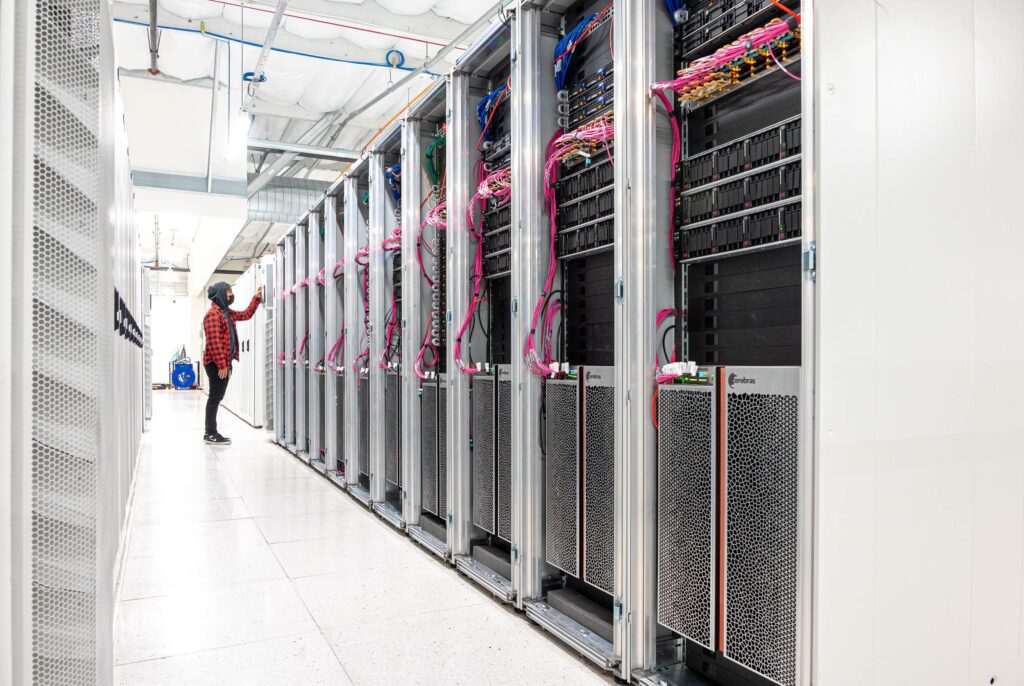

Cerebras is currently building a series of AI data centers for G42, and its technology has been used to train the Arabic large language model that Microsoft is using in its Azure AI platform.