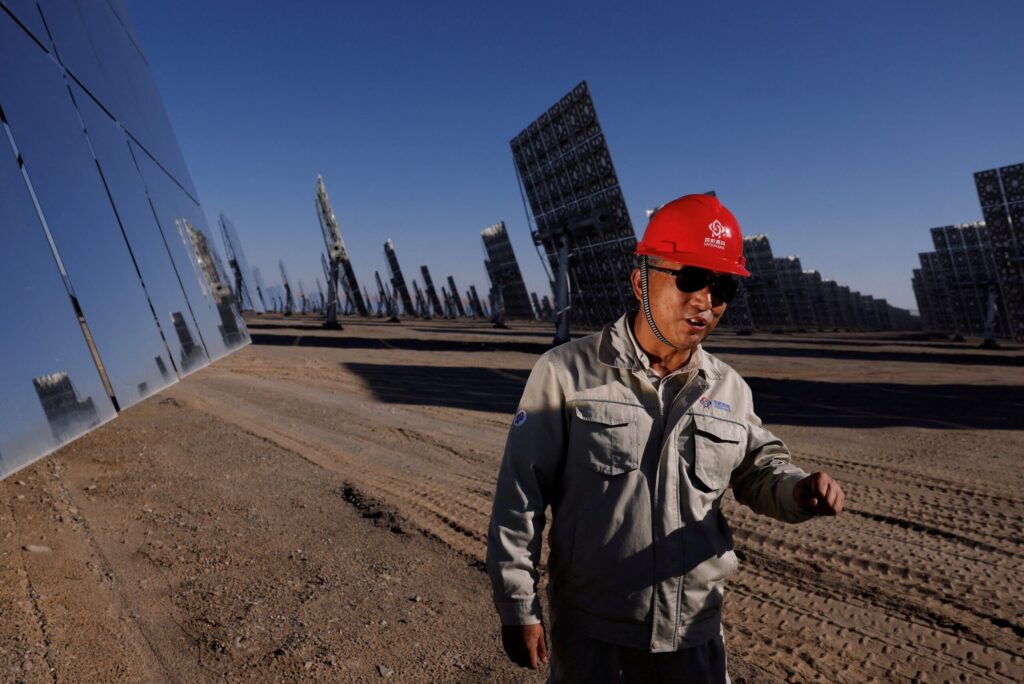

Reuters/Tingshu Wang

China plays a crucial role in renewable energy technology supply chains, producing over 80 percent of solar components and more than 60 percent of wind components.

By 2030 the country is expected to account for 60 percent of the world’s additional renewable energy capacity.

Due to common strategic interests and shared aspirations over energy security, economic diversification and technical cooperation, China is accelerating its collaboration with the GCC states, notably in solar energy projects.

Trina Solar entered the GCC market in 2011 when it founded Trina Solar Middle East Co. Over the years other solar energy giants, such as Jinko Solar, Shanghai Electric, LONGi Green Energy, JA Solar and Solargiga Energy, have also made their mark.

In 2022 Middle East countries, led by the UAE and Saudi Arabia, imported about 11.4GW of solar photovoltaic components from China – a 78 percent increase over the previous year.

Chinese companies have quickly evolved to provide higher value inputs, becoming investors and coinvestors in Gulf countries’ large scale solar projects.

For instance, Jinko Solar has signed an agreement to supply 1GW of solar modules for the Neom Green Hydrogen Project in Saudi Arabia, led by Acwa Power.

Another major project is the Al Dhafra Solar PV Plant in Abu Dhabi, built by China Machinery Engineering Corporation. The plant was inaugurated in 2023, with an installed capacity of 2.1GW, and generates enough electricity to power 200,000 households annually while reducing carbon emissions by 2.4 million tonnes each year.

China-GCC synergies

Benefits from the China-GCC energy partnership flow both ways. In line with the GCC countries’ diversification plans, such as Saudi Arabia Vision 2030 and UAE Net Zero 2050, GCC governments see that China’s manufacturing capacity can enhance decarbonisation efforts by supplying solar panels, wind turbines and batteries.

Western trade protectionist measures imposed on Chinese technologies, coupled with oversupply in China’s domestic renewable energy sector, have driven the prices of Chinese products down.

The US and Europe can no longer compete with China, after the cost of solar modules dropped by 42 percent in 2023 to reach about $0.15 per watt – 50 percent cheaper than those made in Europe and 65 percent less than the US.

The expansion of Chinese-GCC collaboration in clean energy is facilitated by the state capitalism development model, which is characteristic of both the Gulf states and China.

The state capitalism model is typified by state-owned enterprises which negotiate energy deals on both sides, unlocking opportunities for co-development.

In 2019 the Chinese state-owned Silk Road Fund acquired 49 percent in the holding company of Acwa Power, Saudi Arabia’s largest developer and operator of power generation and renewable energy.

A consortium led by Dubai Electricity and Water Authority and Saudi Arabia’s Acwa Power and Silk Road Fund have successfully co-invested in the fourth phase of the Mohammed Bin Rashid Al Maktoum Solar Park in Dubai with an expected capacity of 5,000MW by 2030.

Future of solar energy in the GCC

The current model of economic cooperation has its limitations, however. A major consideration for the GCC is over-reliance on Chinese-controlled supply chains of essential minerals and downstream and processing technologies.

Gulf states have limited opportunities to shape the trajectory of the value chain of renewable energy components. Initiatives to establish solar module production facilities have generally resulted in uncompetitive and unsatisfactory outcomes.

Furthermore, Chinese dominance in manufacturing could increase competition over critical minerals and generate conflicts over the control of value chains, particularly if the GCC targets sectors traditionally dominated by China.

The GCC must establish alliances with alternate suppliers and invest in innovation in its domestic solar industry. Efforts are increasingly focusing in that direction.

For instance, the UAE has recently revised a National Electric Vehicles Policy to fast-track adoption of electric mobility and to develop domestic manufacturing capacity for electric vehicles despite questionable economic viability.

Zeina Moneer is an academic and senior climate practitioner. She is an expert in climate politics, international development and social justice in climate governance and green transition