Qatar’s $526 billion sovereign wealth fund has received approval to acquire a 10 percent stake in China Asset Management Co. It is a rare Gulf investment into one of the country’s largest mutual fund houses as Doha walks a diplomatic tightrope between Washington and Beijing.

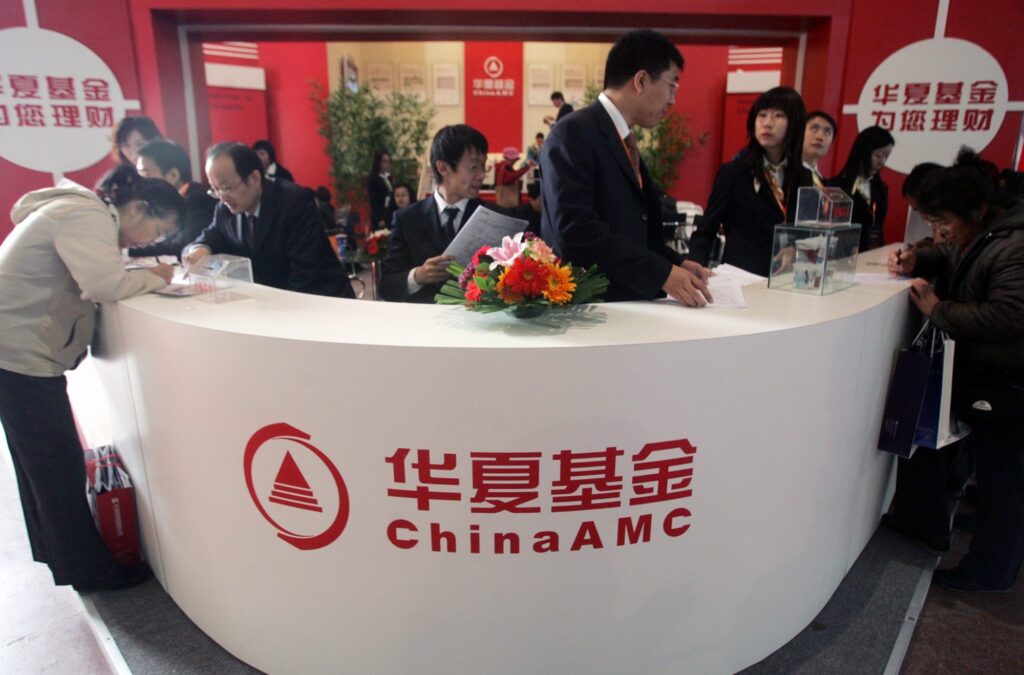

The green light from the China Securities Regulatory Commission was confirmed in an official filing this week, paving the way for the Qatar Investment Authority (QIA) to become the third-largest shareholder in ChinaAMC.

ChinaAMC manages more than 1.8 trillion yuan ($250 billion) in assets across mutual and exchange-traded funds. An ETF is a type of investment fund, and can hold a collection of assets, such as stocks, bonds and currencies. It can be traded on a stock exchange like a regular share.

While financial terms were not disclosed, earlier filings cited by Reuters suggest the stake could cost QIA at least $490 million.

Last week President Donald Trump visited the Gulf, including Qatar, and received pledges from the QIA to double investments in the US.

China is Qatar’s second-biggest customer for its liquefied natural gas exports. LNG exports account for about 60 percent of all exports of the Gulf oil and gas producer.

“We cannot ignore China – it’s a major global market,” Mohammed Al-Hardan, head of technology, media, and telecommunications at the QIA, said at the Qatar Economic Forum this week.

Still, the fund is cautious not to trigger friction with Washington, Al-Hardan said, amid heightened trade tensions between the world’s two biggest economies.

Qatar and China have had diplomatic ties since 1988. Bilateral trade hit more than $24 billion last year, with China importing $20 billion of goods from Qatar – mainly liquefied natural gas (18.3 million tonnes last year) and helium gas.

The QIA has taken stakes in around 90 private companies globally over the past two decades, including 21 in biotech and 11 in software, according to S&P Global. Its 2025 portfolio so far includes six new companies – five in North America and India’s Rebel Foods.