Saudi Arabia’s listed energy companies recorded a combined net profit of SAR 97.76 billion ($26.06 billion) in the first quarter of 2025, marking a 4% decline from the SAR 101.78 billion ($27.14 billion) reported during the same period last year. The dip was primarily driven by a 4.63% drop in profits from industry giant Saudi Aramco.

Despite the overall decrease, the sector’s performance was supported by increased sales volumes across gas, refined and petrochemical products, and integrated logistics services. Higher profit margins were also achieved due to relatively stable operations, improved global shipping rates, and lower financing costs.

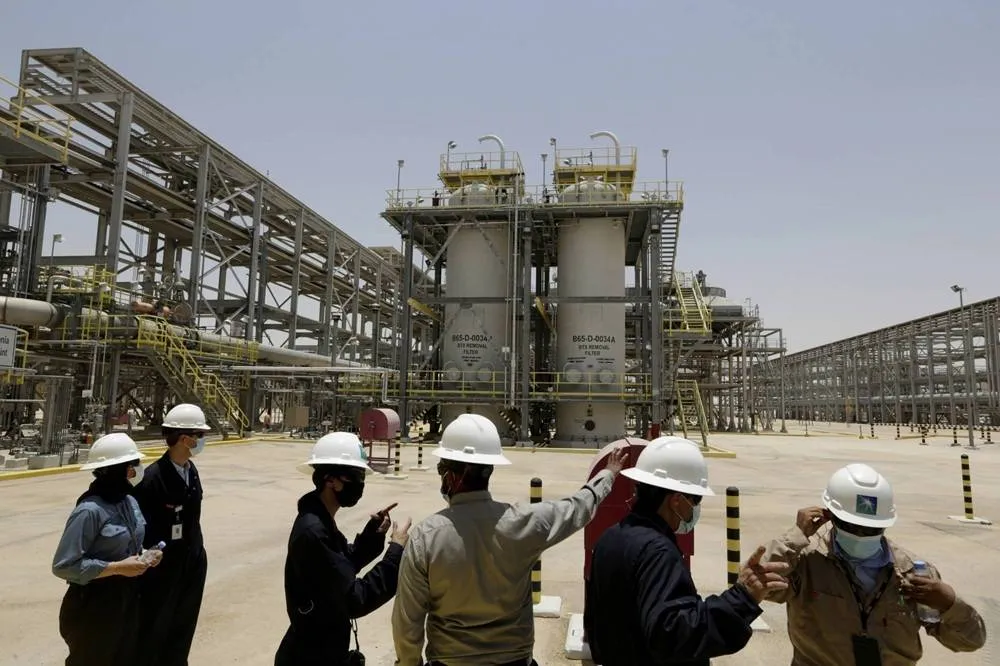

The sector includes seven publicly listed companies: Saudi Aramco, Bahri, ADES, Aldrees, Arabian Drilling, Al-Masafi, and Petro Rabigh.

According to financial disclosures on the Saudi Stock Exchange (Tadawul), all companies in the sector posted profits in Q1 2025, with the exception of Petro Rabigh, which significantly reduced its losses by 49.4%.

Saudi Aramco led the sector with SAR 97.54 billion in profits, despite a slight year-on-year drop from SAR 102.27 billion. Bahri followed, reporting a 17.64% increase in profits to SAR 532.82 million, up from SAR 453 million in Q1 2024.

ADES secured third place with SAR 196.7 million in net profits, reflecting a modest 2.07% decrease from the SAR 200.85 million reported in the same quarter last year.

Aldrees posted the highest growth rate in the sector, with profits soaring by 29.3% to SAR 100.1 million, compared to SAR 77.4 million in Q1 2024.

Commenting on the quarterly results, Dr. Suleiman Al-Humaid Al-Khalidi, a financial analyst and member of the Saudi Economic Association, told Asharq Al-Awsat that the energy sector remains highly profitable, with over SAR 97 billion in earnings underscoring its strength and vital role in the Saudi economy.

He attributed Aramco’s decline to lower global oil prices, reduced production in line with OPEC+ recommendations, and increased operating and capital expenditures.

Mohamed Hamdy Omar, CEO of G.World, echoed this view, describing Aramco as the sector’s “primary engine.”

He noted that falling global oil prices, due to weakened Chinese demand, rising trade tensions, and adjustments in OPEC+ production, negatively impacted revenues across the sector.

He also pointed to rising operating costs as a pressure on profit margins, despite ongoing efforts to boost operational efficiency.