Lira stabilises after March fall

Political protests to continue

Minister welcomes cheap oil

Turkish stocks dropped more than 3 percent on Monday, led by banks and fuelled by a global market selloff over US tariffs and counter moves.

There is also ongoing pressure on the lira due to the jailing last month of Istanbul’s mayor.

Istanbul’s main share index was off 2.5 percent at 08:50 GMT after opening down 3.4 percent. The banking index was down 3.35 percent. The BIST 100 had closed 1.10 percent lower at 9,379.83 points on the previous Friday.

The lira traded at 38.0115 against the US dollar, largely unchanged since a dramatic selloff of as much as 12 percent on March 19 when Ekrem İmamoğlu, the mayor, was detained on graft and other charges that critics said were politicised.

The currency touched a record 42 to the dollar that day before authorities stabilised it with steps including billions of dollars worth of foreign currency sales.

Major global stock indexes plunged again on Monday as US president Donald Trump showed no sign of backing away from his sweeping tariff plans, and as investors bet the mounting risk of recession could see US rate cuts as early as May.

Turkey was slapped with a 10 percent US tariff, lower than many other countries, prompting government officials to point out the potential benefits of being a relatively cheaper source of goods.

Finance minister Mehmet Simsek said the recent lira weakening could cause a rise in April inflation, but he added that disinflation will continue as most of the impact of volatility will be temporary and limited.

Falling oil prices would help reverse Turkey’s current account deficit this year, he said. “Turkey is one of the countries that will be most positively affected by the fall in oil prices and natural gas prices.”

Oil prices fell more than 3 percent on Monday, extending losses from the previous week, on growing concerns that a global trade war could slow the world economy and weaken demand, following China’s retaliation against Trump’s tariffs.

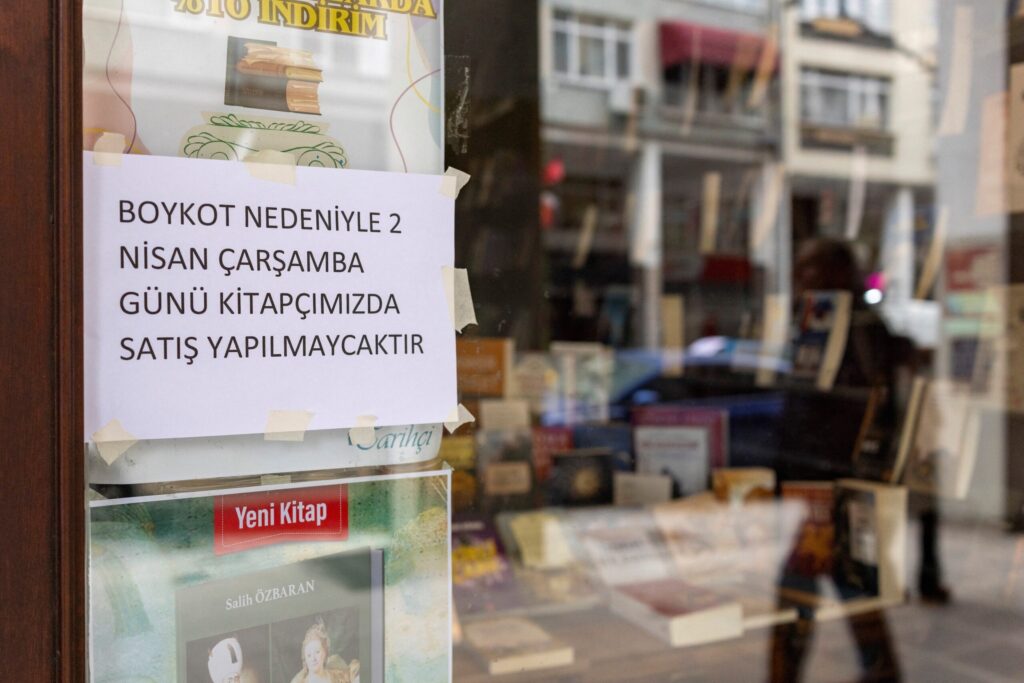

Meanwhile, Turkey’s main opposition leader Ozgur Ozel has pledged further protests against the jailing of Imamoglu, who is President Tayyip Erdogan’s chief rival, aiming to sustain the country’s biggest demonstrations in more than a decade.

Turkish stocks and bonds have largely fallen since İmamoğlu’s detention and later his jailing pending trial, raising concerns among investors over eroding rule of law, criticism Ankara rejects on the grounds that the judiciary is independent.

İmamoğlu was chosen as his party’s future presidential candidate shortly after his arrest.

Register now: It’s easy and free

AGBI registered members can access even more of our unique analysis and perspective on business and economics in the Middle East.

Why sign uP

Exclusive weekly email from our editor-in-chief

Personalised weekly emails for your preferred industry sectors

Read and download our insight packed white papers

Access to our mobile app

Prioritised access to live events

Already registered? Sign in

I’ll register later