Mega deals in energy, technology and artificial intelligence (AI) will continue to influence M&A deals in MENA this year as the region’s sovereigns continue to diversify their economies.

The region performed well in 2025, with announced M&A value increasing 154% year-on-year to $193.1 billion, a record high, according to LSEG Deals Intelligence.

“The M&A landscape will continue to focus on specific sectors such as energy, artificial intelligence and digital infrastructure. This is not surprising given that countries in the region aim to establish themselves as leaders in this space and become globally relevant,” said Ahmed Salem, co-head of MENA investment banking at JPMorgan.

The $55 billion acquisition of US gaming giant Electronic Arts (EA) by Saudi Arabia’s PIF-led consortium was the biggest deal in MENA last year. JP Morgan led the debt financing and advised the consortium.

The number of M&A deals announced in MENA last year increased by 19% across industries and sectors to a record 1,380. JP Morgan ranks second in the LSEG league table with 17 deals valued at $62.6 billion. Goldman Sachs came in first place, followed by Rothschild & Co. in third place with 29 deals.

Salem attributes the strong deal-making to national champions and cash-rich wealth funds making more co-investments and direct investments, with some moving toward buyouts rather than venture and growth stocks.

One of the biggest domestic champion-led deals of 2025 was the $40 billion sale in October of US technology infrastructure company Aligned Data Centers to a consortium comprising AI Infrastructure Partnership (AIP), BlackRock’s Global Infrastructure Partners and MGX, backed by UAE’s Mubadala.

Total outbound M&A deals in MENA in 2025 were $101.2, which LSEG calls an all-time record, although some mega deals in the region did not materialize. For example, Abu Dhabi National Oil Company (ADNOC) declined a $19 billion offer for Australia’s Santos, which would have been one of the year’s biggest energy deals. JP Morgan was one of the advisors on the deal.

“While some large acquisitions have not been completed, they are indicative of the level of ambition the market is starting to see across the region,” Salem said.

flow of capital

According to LSEG data, transactions related to MENA targets reached $80.5 billion in 2025, an increase of 164% year-on-year.

“Some regional companies are not only constantly making outward investments; they are also focusing on monetization efforts that create opportunities for IPOs and subsequent equity investments, or in some cases even complete exits,” Salem said.

Hani Diabez, co-head of MENA investment banking at JPMorgan, highlighted the growing role of the private sector in M&A, pointing to the January 2025 Gulf Data Hub (GDH) transaction. KKR acquired a stake in GDH and pledged to invest more than $5 billion in the GCC’s data infrastructure.

“These are UAE-born, family-run businesses that have demonstrated that they can be great success stories while attracting premium capital to the region. This (GDH transaction) is an example of a top-tier investor investing in a local company,” Diabez said.

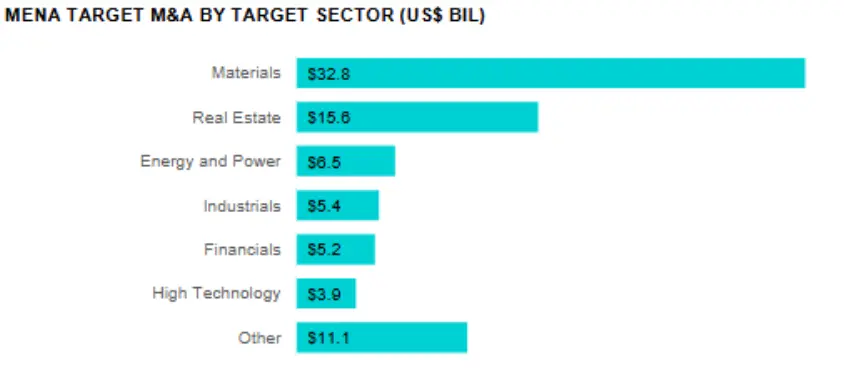

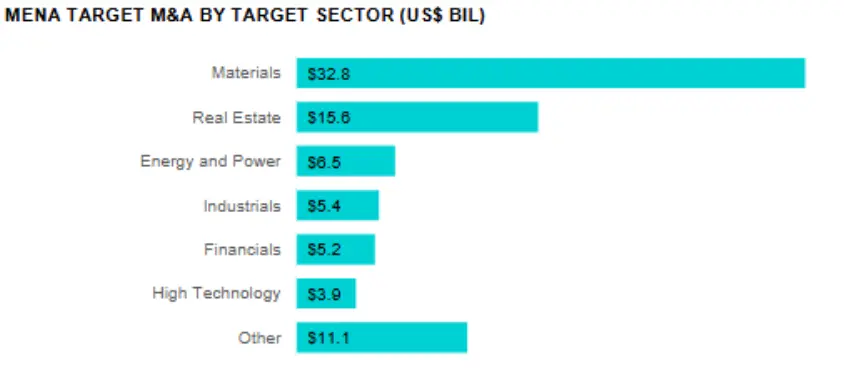

LSEG data highlights materials as the most active sector in 2025, accounting for 41% of MENA-targeted M&A by value, driven by ADNOC and OMV’s merger of chemicals companies Voluge and Borealis, with real estate and energy rounding out the top three sectors by value, although financials and tech had the highest number of deals.

Outlook for 2026

Geopolitical headwinds, including the threat of prolonged tensions between the U.S. and Iran, have destabilized markets in recent weeks, but many analysts and bankers expect the long-term impact to be muted.

“We’re entering a period where oil could be under pressure again, and we’re much better prepared than we were during the last downturn. We’re optimistic both from a fiscal perspective and from the potential impact on more resilient trading activity,” Diabez said.

According to Salem, market cyclicality is common in the M&A and ECM markets. “If you ask me, will there be another EA-like mega-deal? Yes, it is possible. There is still so much untapped potential and ambition in the region to achieve, so I see no reason for activity to slow down.”

(Reporting by Bindu Rai; Editing by Seban Scaria)

Bindu.rai@lseg.com