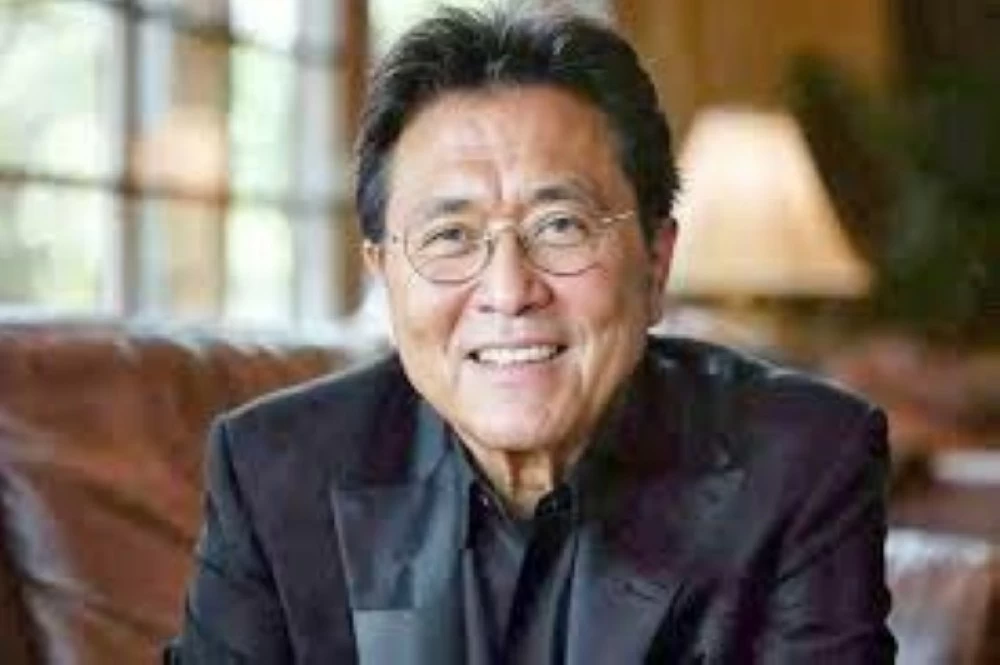

After publishing a new tweet announcing the purchase of an additional 600 pieces of sterling silver, renowned American investor and author Robert Kiyosaki is back to stir up controversy in the market, in a move that reflects his growing bet on the white metal in the coming years.

“Silver spot price has reached $82 per ounce,” Kiyosaki said in his tweet. He stressed that this level is still far from the actual value the metal is expected to reach by the end of the year.

The author of Rich Dad Poor Dad admitted he still believes silver prices will reach more than $200 an ounce by 2026. It’s a prediction he has repeated for months, saying it reflects “structural imbalances” in the global monetary system.

rapid fluctuations

Kiyosaki believes that silver, along with gold and Bitcoin, is a reliable safe haven in light of what he describes as “the failures of the traditional financial system,” which is why he has announced multiple increases in his holdings of the precious metal.

It is worth noting that the price of silver has fluctuated rapidly in recent years due to factors such as increased industrial demand, geopolitical turmoil, and investor trends towards tangible assets. However, overly optimistic forecasts such as those offered by Kiyosaki are still widely debated among analysts and investors.

Renowned American investor and author Robert Kiyosaki caused a stir in the market after posting a new tweet announcing the purchase of an additional 600 pieces of sterling silver, a move that reflects his increased bet on the white metal in the coming years.

“Silver spot price has reached $82 per ounce,” Kiyosaki said in his tweet. He acknowledged that this level is still far from the true value he expects the metal to reach by the end of the year.

The author of Rich Dad Poor Dad believes the price of silver will reach more than $200 an ounce by 2026, a prediction he has reiterated for months, reflecting “structural imbalances” in the global monetary system.

rapid fluctuations

Kiyosaki believes that silver, like gold and Bitcoin, is a reliable safe haven given what he calls the “failure of the traditional financial system,” and has therefore announced multiple consecutive increases in his precious metal holdings.

It’s worth noting that silver prices have fluctuated rapidly in recent years due to factors such as increased industrial demand, geopolitical turmoil, and investors’ shift towards tangible assets. However, extremely optimistic forecasts such as those proposed by Kiyosaki are still widely debated among analysts and investors.