Q Fund backs AI startup QPioneers in first funding round

News • December 22, 2025

edit

arabic

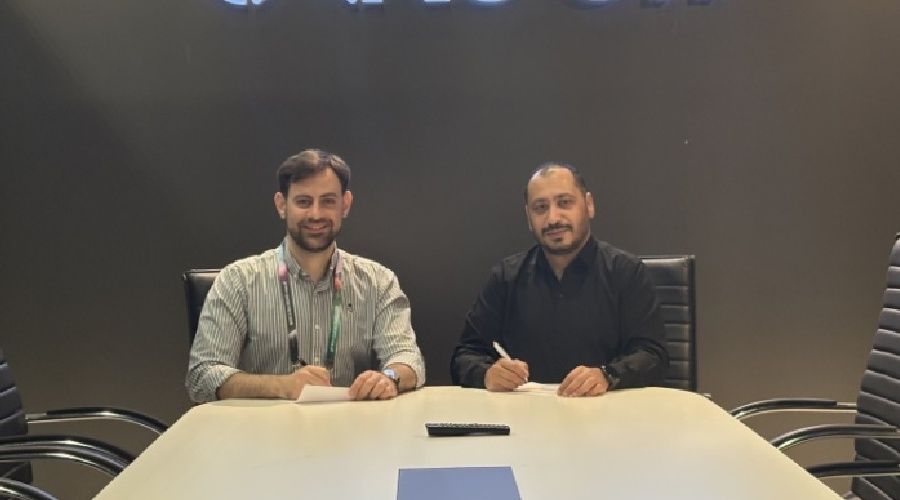

Saudi Arabia-based AI-powered startup QPioneers has raised its first round of funding for an undisclosed amount from Q Fund, the investment arm of Qewam Holding. Founded in 2024 by Hisham Al Mamlouk and Adel Alsaadi, QPioneers builds startup operating systems (StartupOS) that integrate collaboration tools, operations, and analytics into one workspace. This is supported by an AI assistant that automates workflows and provides strategic insights. The funding will be used to accelerate product development, hire key talent, and strengthen engagement with the region’s startup community.

press release:

Q Fund, the investment arm of Qewam Holding, announced the successful completion of its first funding round for QPioneers, a technology startup developing an AI-powered integrated platform designed to manage and operate startups more efficiently.

This investment reflects Q Fund’s strategy to support technology-driven solutions that drive operational efficiency and enable scalable growth across regional markets. QPioneers is positioned as an AI-native startup operating system (Startup OS) tailored for growth-stage teams, combining collaboration tools, operations management, and intelligent analytics within a single workspace.

At the core of the platform is QP Agent, an intelligent assistant that learns from a company’s internal data to automate workflows, support daily operations, and provide data-driven recommendations to founders and teams. QPioneers aims to reduce operational complexity by unifying tools and processes, allowing startups to focus on execution and scaling.

Commenting on the investment, Q Fund CEO Rewa Abukait said early-stage investments in deep technology are central to building resilient economic ecosystems, noting that platforms focused on improving operational efficiency are likely to shape the next stage of startup growth.

Hisham Al Mamluk, Founder of QPioneers, said the partnership with Q Fund goes beyond capital, highlighting the value of participating in an integrated investment ecosystem that provides access to the strategic guidance and networks needed to expand from regional to global markets.