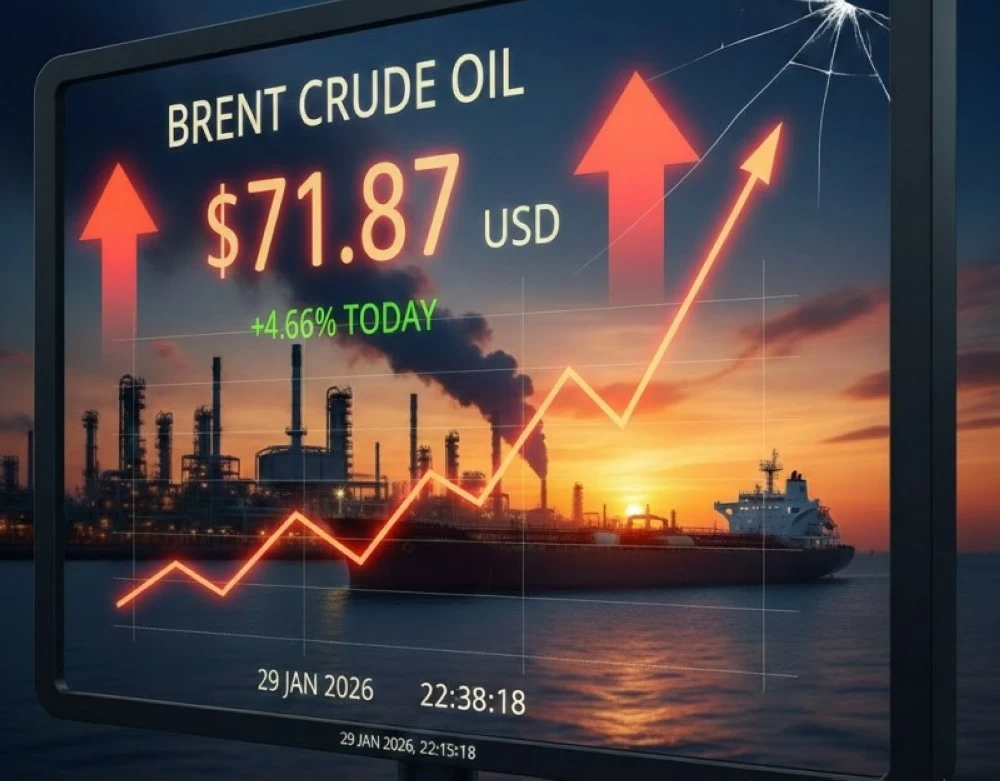

Due to growing concerns about geopolitical events, Brent crude oil futures prices soared at the close of trading today (Thursday), reaching their highest level in five and a half months, specifically since August 1, 2025, as the price of a barrel reached the $71.87 level during the session.

Global benchmark oil prices rose as much as 4.66%, with the price of U.S. West Texas Intermediate crude above $66, amid renewed risks of conflict that could disrupt oil exports from Iran or cause ripple effects on global markets if a vital sea route is shut down.

“The American vessels I have ordered to the region stand ready to carry out their mission swiftly and violently if necessary,” President Trump said in a social media post last Wednesday.

Oil prices have risen markedly since early 2026, outpacing expectations that the market would be adversely affected by a significant oversupply. However, major disruptions to supplies from Kazakhstan, as well as geopolitical tensions ranging from Iran to Venezuela, helped support prices.

President Trump’s latest threats have added a risk premium to prices, even as the market faces downward pressure from expected increases in supply. Traders are paying high premiums for the longest bullish call option in nearly 14 months to hedge against the risk of a new conflict between the United States and Iran.

In recent years, the options market has formed a major channel for traders to bet on rising geopolitical risks in the Middle East, with option buying premiums soaring after a US military strike on Iran in 2025, only to fall later when it became clear that no oil facilities were damaged.

Increasing concerns over geopolitical events caused Brent crude oil futures prices to soar at the close of trading today (Thursday), reaching their highest level in five and a half months since August 1, 2025, as the price of a barrel during trading reached $71.87.

The world’s benchmark crude oil price rose as much as 4.66%, with the price of West Texas Intermediate crude above $66, as the risk of a conflict that could disrupt oil exports from Iran or close a vital sea route could have far-reaching implications for global markets rises again.

“The U.S. warships I have ordered to the region stand ready to carry out their mission swiftly and violently if necessary,” President Trump said in a social media post last Wednesday.

Oil prices have risen markedly since early 2026, outpacing expectations that the market would be adversely affected by a significant oversupply. However, geopolitical tensions ranging from Iran to Venezuela and a major supply bottleneck from Kazakhstan are helping to support prices.

President Trump’s latest threats pose a premium risk to prices, even as the market faces downward pressure from expected increases in supply. Traders are paying high premiums for the longest bullish call option in nearly 14 months to hedge against the risk of a new conflict between the United States and Iran.

In recent years, the options market has formed a major channel for traders to bet on rising geopolitical risks in the Middle East, with premiums for call options soaring after a US military strike against Iran in 2025, only to retreat later when it became clear that no oil facilities had been damaged.